Small Business Spreadsheet Starter Pack - Planning, Cash Flow and Accounting

Our Top 3 Essential Business Tools - bundled together at a discounted price.

Take a look at the individual products above and then consider the following:

You are legally required to maintain accounting records for your small business. So having an accounting system in place is 100% mandatory.

However, there is NO legal requirement for you to PLAN your business and there is NO legal requirement for you to project your business Cash Flows.

As an accountant in practice, I believe that both Business and Cash Flow planning are MORE important than simply keeping accounting/bookkeeping records.

You want your business to succeed – don’t fall over at the first hurdle!

To succeed you need to Plan, and this is the process I recommend.

Step 1 – Your Financial Business Plan.

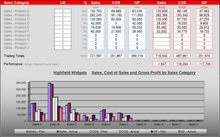

You need to plan your business Income Streams and fully evaluate your Cost of Sales.

These simple steps will help you determine your Gross Profits. Quite simply you take the Sales Value of your Goods and/or Services and deduct any direct costs such as materials, carriage, contractor’s costs etc. Our Financial Business Planning spreadsheet will cater for up to 10 different Income Streams and associated costs. So you can accurately plan your optimum Sales Mix.

Now calculate your Business Expenses.

Once you have fully evaluated your Income Streams and costs you will arrive at a Gross Profit figure in $ Value and in % terms. Now you will need to assess your other business overheads such as premises costs, admin charges, professional fees, car and truck expenses, marketing, finance fees etc.

Our Financial Business Planning Spreadsheet caters for up to 100 separate expense types which are categorized into 10 main headings.

Your aggregate business expenses will be deducted from your Gross Profit in Stage 1 to give you your Planned/Estimated Net Profit.

Then, Perform ‘What If’ scenarios on your data.

With all of your Income Streams, Cost of Sales and Overheads fully accounted for, you can then perform multiple ‘What If’ scenarios. An example would be ‘What happens if my Gross Profit for Income Stream B goes up by 20% and my contractor costs increase by 5%.

The spreadsheet calculates everything automatically and the data is presented in both numeric and graphical formats.

Now, continue with ongoing appraisal and adjustments.

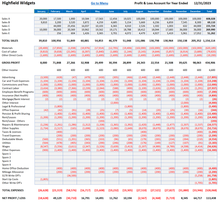

Once you have ‘Finalized’ your Financial Business Plan you can update the file with your Actual Results for each period. This helps you to easily see how you are performing against your original estimates and allows you ‘Tweak’ the system to correct and fine tune your original assumptions.

Performing these simple but essential tasks will ensure that you stay ‘ahead of the game’ with your business planning.

Step 2 - Cash Flow Forecasting

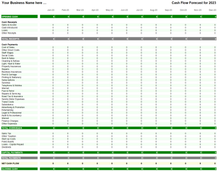

So, you now have a cogent business plan, your estimated profitability looks good, and everything seems to be in place for your business to succeed.

But wait, have you considered how and when your Income Streams will ‘end up’ in your bank account? Have you thought about how to finance your Inventory requirements? What about Sales Taxes? What if you want to finance a new truck? What if your receivables change from 30 days to 60 days?

All these issues involve Cash. Both when you receive it and when you pay it.

We all know the consequences of running out of money before the end of the month, so in our personal lives we plan for these contingencies.

You should do EXACTLY the same for your business cash flows. In fact, the most common reason small businesses fail is that they do not manage cash correctly.

From the outset, a Cash Flow Forecast based on your Financial Business Plan is vital.

Our Advanced Cash Flow Forecaster is fully equipped to accurately monitor Income and Expenses to ensure that your business highlights cash flow shortfalls. You can then take early steps to ensure that your business is not compromised by this.

Step 3 - Monthly Accounting

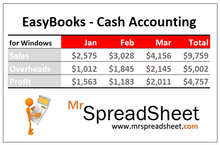

All businesses are legally required to keep records of their financial transactions.

Our EasyBooks Accounting Spreadsheets are designed to make this process both quick and simple.

Take a look at the individual products to see how the Spreadsheets work and how they cater for 1099 contractors, sales taxes, business write off’s etc.

Now, if you have fully planned your business and have projected your cash flows, then your monthly accounts should approximate your estimates.

In other words, you early planning is endorsed by your ongoing results.

Differences are easy to spot and corrective action can be built into your plans.

So, stay ahead of the game ‘Plan your Business’, ‘Plan your Cash Flows’, ‘Monitor the Results’.

Do these things and you have every chance of success.